2025 401 K Contribution Limits

2025 401 K Contribution Limits. The 401(k) contribution limit for employees in 2025 has increased to $23,500, up from $23,000 in 2024. The 2025 401(k) contribution limit increased to $23,500, up from $23,000 in 2024.

Maximum contribution limits for 401(k) plans are rising by $500 for many workers in 2025. In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

2025 401 K Contribution Limits Images References :

Source: june2025calendarprintablefree.pages.dev

Source: june2025calendarprintablefree.pages.dev

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Source: harryhill.pages.dev

Source: harryhill.pages.dev

Max 401k Contribution 2025 Over 50 Rules Harry Hill, The irs has announced higher 401(k) contribution limits for 2025, which can help you increase your savings if you are participating in these plans.

Source: mayandjune2025calendar.pages.dev

Source: mayandjune2025calendar.pages.dev

2025 401(k) Contribution Limits Maximizing Your Retirement Savings, The irs raised the standard 401(k) contribution limit.

Source: june2025calendarprintablefree.pages.dev

Source: june2025calendarprintablefree.pages.dev

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, Good news for 401(k) account owners:

Source: samrussell.pages.dev

Source: samrussell.pages.dev

401k Contribution Limits 2025 Under 50 Sam Russell, In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Source: mariascott.pages.dev

Source: mariascott.pages.dev

2025 401k Contribution Limit Catch Up Maria Scott, The irs raised the standard 401(k) contribution limit.

Source: rebeccastewarts.pages.dev

Source: rebeccastewarts.pages.dev

401k Limit 2025 Combined Employer Rebecca Stewarts, Starting in 2025, employees can contribute up to $23,500 into their 401 (k) and 403 (b) plans, most 457 plans, and the thrift savings plan for federal employees, the irs announced nov.

Source: anissashelba.pages.dev

Source: anissashelba.pages.dev

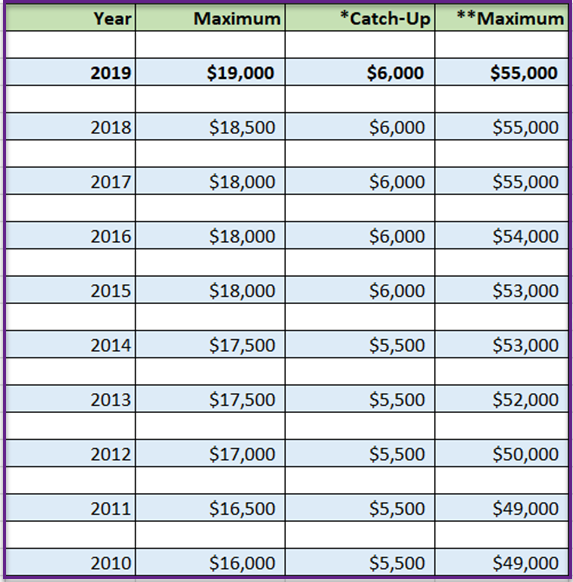

2025 401 K Contribution Limits Moll Domeniga, This wsj article (paywall) has a handy chart for reference.

Source: june2025calendarprintablefree.pages.dev

Source: june2025calendarprintablefree.pages.dev

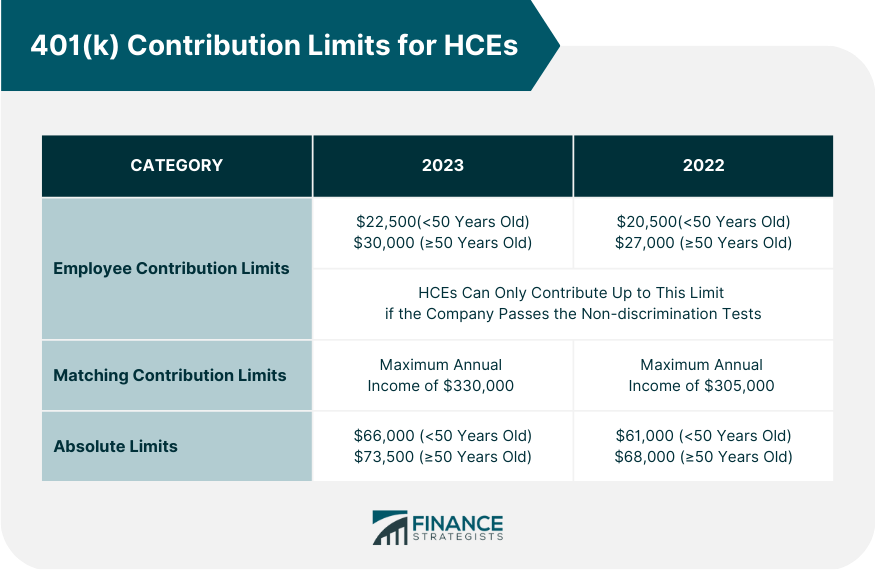

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, Employees age 50 and older can contribute an additional $7,500 for a total of $31,000.

Source: neilterry.pages.dev

Source: neilterry.pages.dev

401 K CatchUp Contribution Limit 2025 Neil Terry, For tax year 2025, employees can defer $23,500 into their 401 (k) and iras, a modest increase from the $23,000 contribution limit in 2024.

Posted in 2025